.png)

.png)

SAP S/4HANA Finance is SAP’s flagship financials solution and successor to SAP ERP Financials. First released in 2014, it introduced major process improvements such as a single source of financial truth through the Universal Journal, real-time financial close capabilities, and predictive accounting. Built natively on the SAP HANA platform and primarily accessed through the SAP Fiori user interface, SAP S/4HANA Finance enables organizations to move from reactive reporting to real-time financial insight. It is particularly valuable for CFOs, finance leaders, controllers, and SAP FICO professionals who need faster close cycles, improved transparency, and data-driven decision-making in complex, global business environments.

Originally termed SAP Simple Finance, the solution was launched at the 2014 SAPPHIRE NOW technology conference in Orlando, Florida. Nine months later, it would undergo a name change to SAP S/4HANA Finance when SAP announced its new SAP S/4HANA enterprise resource planning platform, broken down into lines of business such as finance, supply chain, sales, and more.

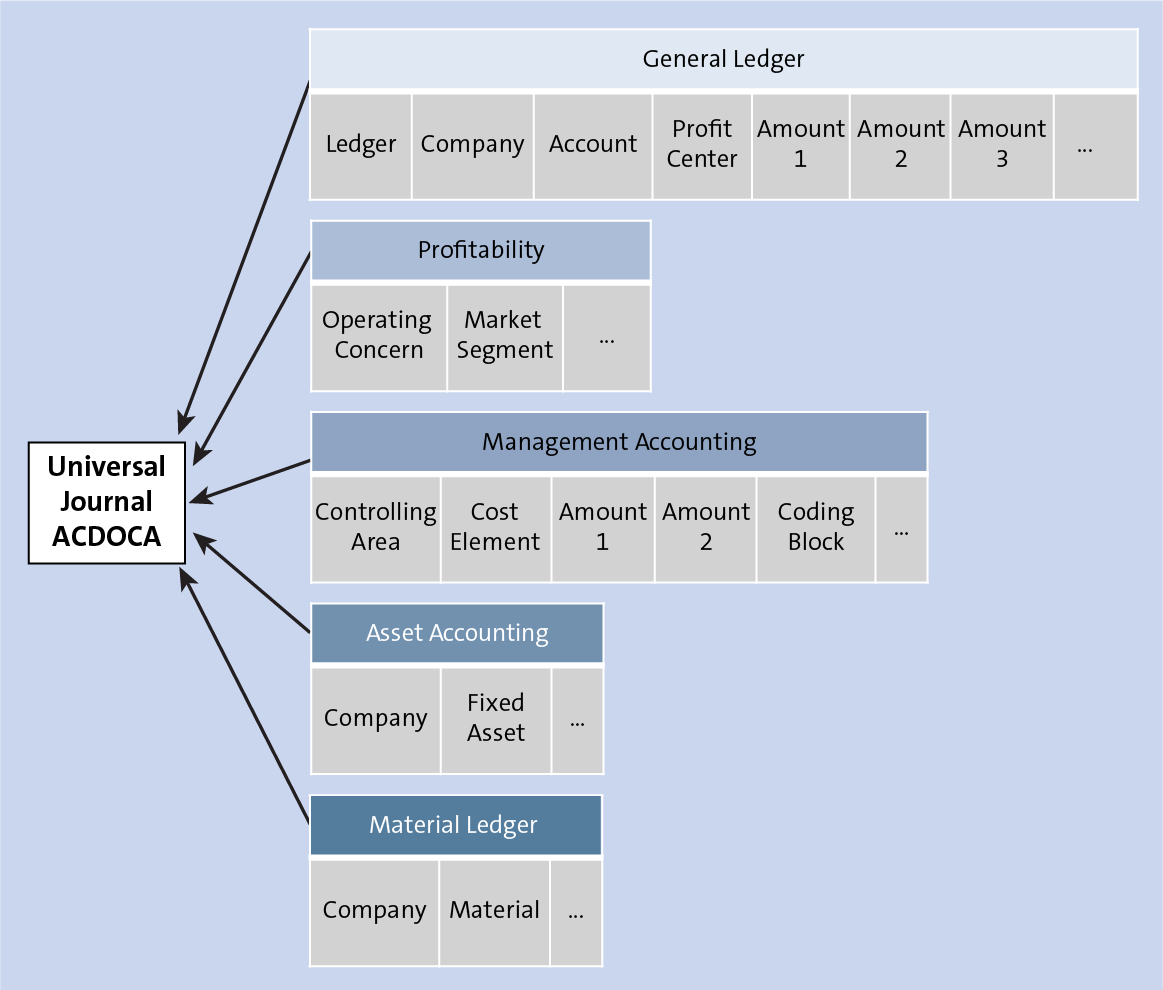

Innovative features of the first release of SAP S/4HANA Finance included the Universal Journal that provided a single place to store both financial and management accounting documents with relevant details. This led to better reporting, easier access to KPIs utilized by managers, and cockpits tailored to specific end users to help them make more informed decisions.

Since then, SAP has continuously built upon the foundation of SAP S/4HANA Finance. Major yearly releases have added new, innovative functionality to the solution, and as of 2019, SAP S/4HANA’s latest features include improved financial closing capability, centralized payables and receivables, predictive accounting, and more embedded analytics.

Central to the SAP S/4HANA Finance solution’s unique selling proposition are the process and reporting improvements available thanks to SAP HANA. While some of these were just processing speed upgrades—the SAP HANA database boasts analytics and reporting capabilities that are 1800x faster than SAP ERP—many were brand-new to SAP S/4HANA Finance. This includes things like the Universal Journal, centralized processing, data drilldown, and ability to integrate multiple ERPs into one place for data collection.

SAP was clear from the beginning that the “simple” in SAP S/4HANA Finance’s first iteration was multifaceted. Those using the new solution would find not only automatic, up-to-the-minute financial reporting, but a streamlined data model and lightweight architecture.

Initial FI-CO functionality improved upon the existing ERP. This included updated financial planning and analysis, accounting and financial close, treasury and financial risk management, collaborative finance operations, and enterprise risk and compliance management.

Learn more about how finance differs between SAP ERP and SAP S/4HANA in this post.

SAP S/4HANA Finance introduced to the financial world the tangibility of a single source of truth—that is, an aggregated total of all financial data across departments, ledgers, and even continents. This was enabled by SAP HANA’s ability to store large amounts of data in-memory and to produce analytics reports at a moment’s notice for anyone with access who wanted it. This provided immediate value to accountants looking at current and past activity, project managers running complex projects on tight budgets, and planners looking to utilize past and present numbers to forecast future expectations.

There are multiple avenues through which SAP S/4HANA Finance can be deployed. Here’s a brief overview of each.

An on-premise deployment encompasses traditional in-house IT infrastructure models. This deployment model describes an instance of SAP S/4HANA Finance that is physically hosted on company property.

There are two cloud options for SAP S/4HANA Finance deployment, both of which involve the use of external cloud integration. In a public cloud deployment, a company leases a siloed piece of server space shared with other clients running SAP S/4HANA. In a private cloud deployment, a company leases a unique server to run SAP S/4HANA. In both cases, the application is owned by the customer but all management of the technical infrastructure is outsourced.

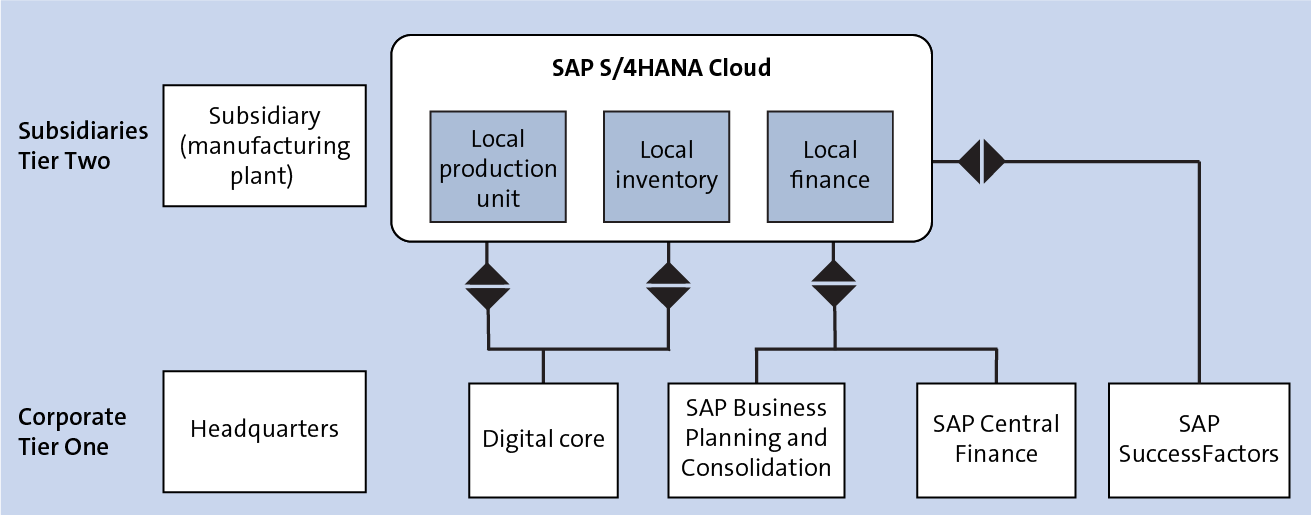

In a two-tier or hybrid deployment, both on-premise and cloud deployments are utilized. This may be done for a number of reasons, including testing the feasibility of both instances or hosting an on-premise deployment at headquarters while utilizing a cloud deployment in a satellite office.

This table lists some key differences between on-premise SAP S/4HANA and SAP S/4HANA Cloud.

| On-Premise | Cloud | |

| Deployment and Maintenance | Managed by internal IT teams | Maintained by SAP with automatic quarterly updates |

| Customization | High flexibility for customization | Limited customization options |

| Scalability | Requires hardware investment | Easily scalable with cloud resources |

| Cost Structure | Higher upfront costs with ongoing maintenance expenses | Subscription-based with predictable expenses |

| AI Integration | Requires manual integration of AI tools | Built-in AI capabilities like Joule and iSLM |

Depending on a company’s unique business requirements, one of the following three migration options will make the most sense. These can be performed in house or with the use of third-party consultants.

In a greenfield implementation, the SAP S/4HANA system is built from scratch and initially contains no data. This is the implementation all new SAP customers undertake. Some existing SAP customers may choose to perform a greenfield implementation if they have an over-customized, legacy, SAP ERP Financials system.

In a brownfield implementation, an existing SAP ERP Financials system is converted into an SAP S/4HANA Finance system. This involves the migration of financial data from the legacy system to SAP S/4HANA. Companies that did not heavily customize their legacy system might be drawn to this approach rather than starting from scratch.

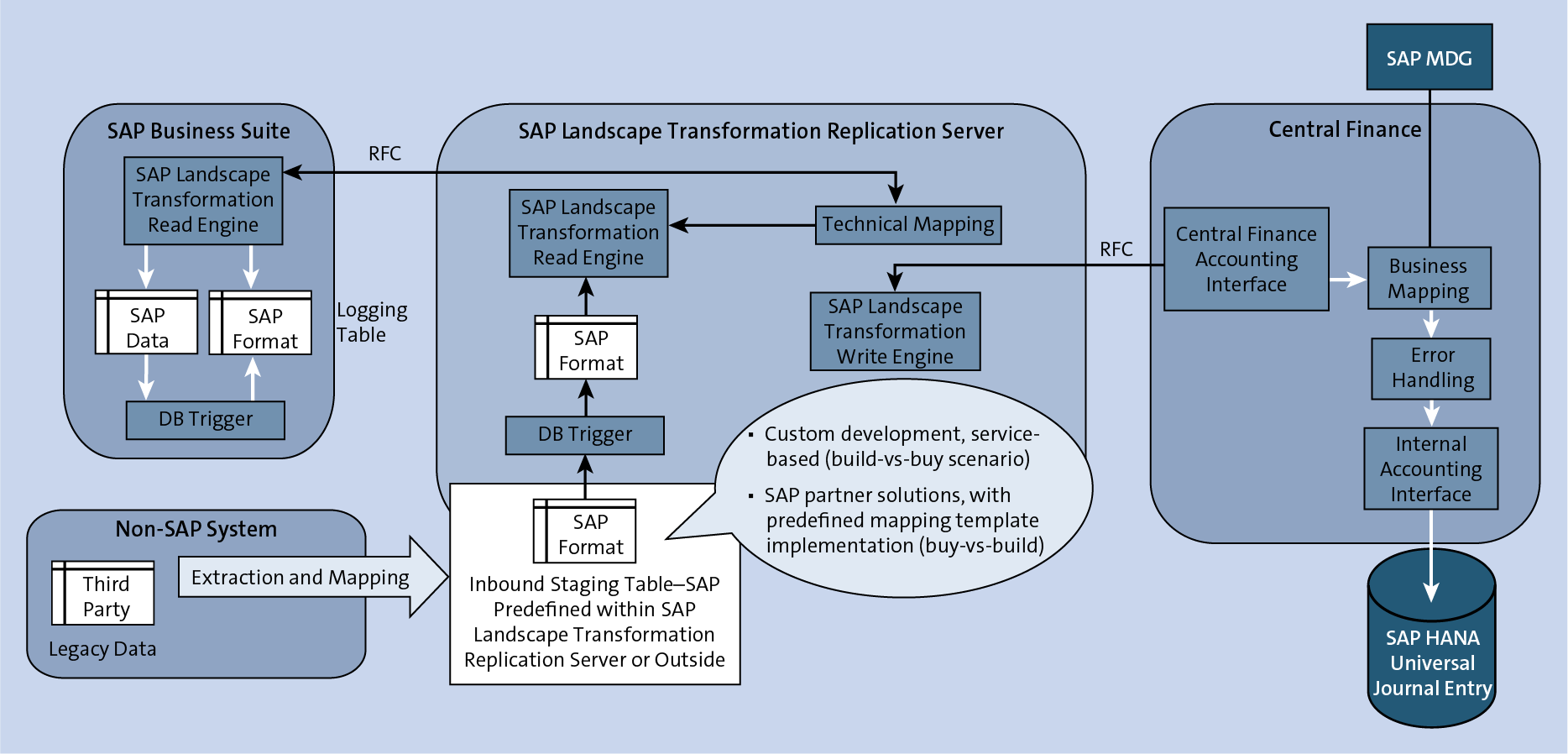

In a Central Finance implementation, disparate financials systems in SAP ERP are connected to a single Central Finance system. This mimics the single source of truth that SAP S/4HANA Finance provides, and allows the reporting and analytics benefits of SAP S/4HANA Finance to be used on data.

SAP S/4HANA Finance receives multiple updates each year. Cloud-deployed instances will receive quarterly updates, while on-premise deployments are updated every other year.

The naming conventions for SAP S/4HANA releases follows this four-digit format: year/month. For example, the 1909 release of SAP S/4HANA refers to the release that came out in the year 2019 (19), month of September (09).

Here are answers to some of the most common things business users want to know about SAP S/4HANA Finance.

What is SAP S/4HANA Finance?

SAP S/4HANA Finance is the next-generation financials solution from SAP, built on the SAP HANA in-memory platform. It replaces SAP ERP Financials and introduces innovations like the Universal Journal and real-time reporting.

How is SAP S/4HANA Finance different from SAP ERP Financials?

It features a simplified data model, real-time analytics, a modern SAP Fiori UI, and faster financial close capabilities. Unlike its predecessor, it unifies FI and CO data in the Universal Journal.

What are the deployment options for SAP S/4HANA Finance?

You can deploy SAP S/4HANA Finance on-premise, in the cloud (public or private), or in a hybrid two-tier setup combining both.

What is the Universal Journal in SAP S/4HANA Finance?

The Universal Journal is a single, consolidated table (ACDOCA) that stores financial and controlling data. It simplifies reporting and improves data accuracy.

What are the migration paths to SAP S/4HANA Finance?

You can migrate using a greenfield (new implementation), brownfield (system conversion), or Central Finance approach, depending on your current setup and goals.

What are some key features of SAP S/4HANA Finance?

Notable features include predictive accounting, embedded analytics, centralized payables and receivables, and support for event-based revenue recognition and universal parallel accounting.

How often does SAP S/4HANA Finance get updated?

Cloud deployments receive quarterly updates, while on-premise deployments are updated once every other year.

In addition to the information laid out above, there are a handful of important SAP S/4HANA Finance terms you should also be familiar with. Here are they are in list form:

Eager to learn more about SAP S/4HANA Finance? These blog posts and books can help, as well as this SAP FICO learning journey.

Learn more SAP from our official Learning Center.

And to continue learning even more about SAP S/4HANA Finance, sign up for our weekly blog recap here: